February 2025

#TRENDING

Parenthood in a complex and expensive world

Parenthood today is more complicated—and more expensive—than ever before. With nearly 92% of families having at least one parent in the workforce,1 it’s crucial for employers to understand the pressures parents are facing. From financial strain to juggling work-life balance, these challenges directly impact the well-being of your employees. Gaining an understanding of this large cohort can help better inform benefits and engagement programs at your company.

As a new parent, [I’m] exhausted. I work in a stressful profession as well, so the exhaustion plus work stress is a lot to process.”

The average age of first-time parents has risen to 26.9, a sign that many are waiting longer to start families, often to build their careers and savings first. Yet, while the ability to build financial stability before parenthood is beneficial, it also highlights a stark reality: raising a child has become a far greater financial burden than it used to be.

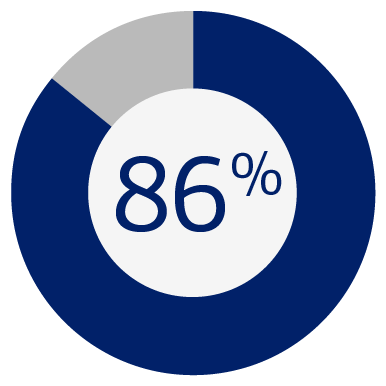

86% of Americans agree that it’s tougher than ever to be a parent.

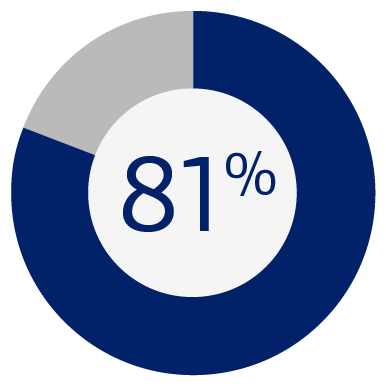

81% say it’s more expensive than ever to raise a child.

A growing strain on parents

As parents delay having children, they face a unique set of challenges—the so-called “big squeeze”. Parents now are not only caring for young children but also looking after aging relatives and navigating the demands of advanced careers. This intersection of responsibilities leads to skyrocketing stress—physically, emotionally, and financially. Companies should consider offering more flexible work arrangements and benefits to support employees dealing with these dual caregiving responsibilities, especially for women since this burden tends to fall more on them.

60% of caregivers are women.2

The modern parent: More involved, more stressed

Recent surveys show that 63% of Americans believe parents should be involved in every aspect of their children’s lives. This shift reflects a more engaged, hands-on approach to parenting where moral guidance, life skills, and emotional support are at the forefront of parental duties. Parents today aren’t just providing basic care; they’re shaping their children’s values, guiding them through the complexities of the world, and helping them develop the critical thinking skills necessary to navigate an ever-changing landscape.

Yet, the more involved parents are, the more it can take a toll on their personal well-being. Women often carry a disproportionate share of the emotional labor within families. This imbalance requires a more nuanced understanding of parental roles, not only to better support parents but also to help balance family dynamics and mental health.

Mothers feel responsible for 73% of all cognitive household labor, such as comforting and disciplining, while their partners were perceived to take on only 27% of these tasks.

Children’s financial literacy: A growing imperative

When it comes to children’s financial literacy, parents are feeling the pressure more than ever. With kids spending more and more—often through easy-to-use digital payment methods—75% of Americans believe kids don’t fully understand the value of a dollar. This is where the challenge lies: parental money mindsets deeply influence what children learn about finance. If parents struggle with budgeting or overspending, it becomes difficult to pass down healthy financial habits. And, for many parents who feel uneasy about their own financial management skills, they lack the confidence to proactively teach their kids sound money practices.

84% of Americans agree that parents need to do more to teach their children about money.

A complex, ongoing journey

The bottom line: your employees—and perhaps even you—are dealing with a lot. Understanding the modern challenges parents face can help businesses better support their workforce, which in turn can help improve overall well-being, increase productivity, and strengthen attraction and retention efforts. Demonstrating that your company is making proactive efforts to support them can go a long way in creating an engaged and loyal workforce.

Key takeaways

- Consider offering flexible work arrangements and benefits to support employees juggling multiple caregiving responsibilities.

- Promote Better Money Habits, our online educational resource that offers a wide array of financial education for individuals as well as for families on topics such as teaching money skills, managing finances, and providing care for elders.

- Encourage employees to tune into educational seminars, webcasts, audiocasts and more. You can see what’s coming up on our Events Center website.

Source for all stats unless otherwise noted: Bank of America Proprietary Market Landscape Insights Study, December 2024. Surveys conducted among general consumers (clients and prospective clients).

1 Bureau of Labor Statistics, U.S. Department of Labor, April 24, 2024.

2 Bureau of Labor Statistics, U.S. Department of Labor, November 30, 2024.