June 2024

FINANCIAL WELLNESS

First quarter shows positive plan trends

The quarterly release of our Participant Pulse report provides a snapshot of employee confidence in their retirement planning and overall financial wellness based on behaviors of participants in the plans we recordkeep.

HSA contributions saved

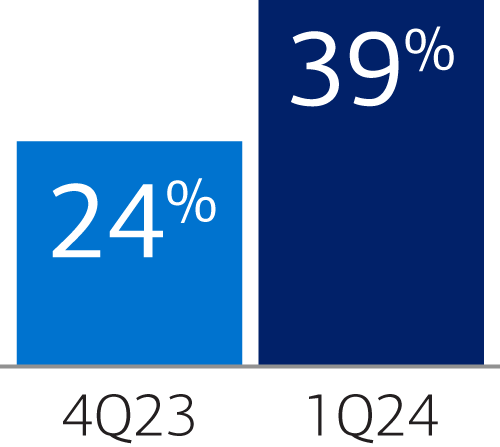

In the first quarter of 2024, we see a positive trend in how employees are using their Health Savings Account (HSA) to save for the future. Account holders are saving 39% of their contributions versus withdrawing them—compared to 24% at the close of 2023.

Yet there’s still an opportunity to help participants understand the benefit of investing their HSA balance for future potential growth, as only 13% are taking advantage of the investment feature of their account. Digging into investment behaviors a bit deeper, more men (18%) than women (12%) invest their HSAs—and more Baby Boomers (16%) are investing compared to other generations.

Other noteworthy findings include a slight rise in 401(k) contribution rates, with an average contribution rate of 6.6% in 1Q24. In addition, the average 401(k) account balance increased by 17% since the close of 2023.

Download the Participant Pulse report today, and talk with your Bank of America representative about strategies to help promote employee engagement and to support them in getting the most out of the benefits you provide.